Apple Inc (AAPL) Q2 Earnings: Slight Decline in Revenue but Surpasses EPS Estimates

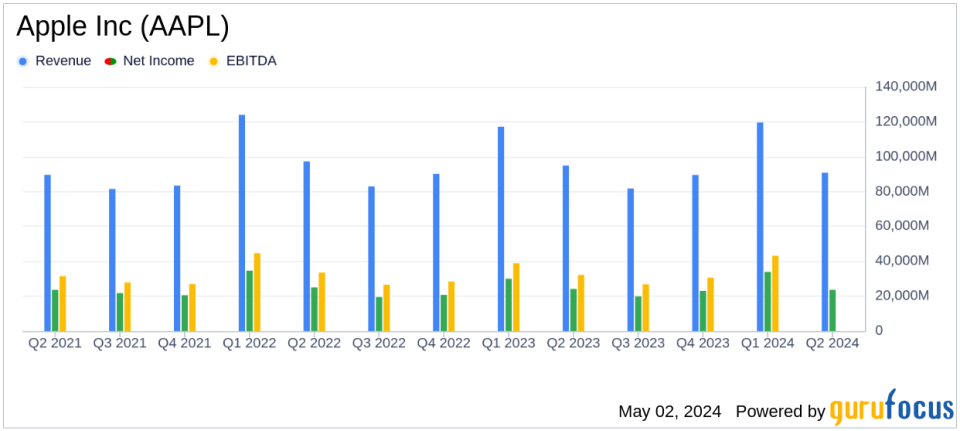

Quarterly Revenue: Reported at $90.8 billion, marking a 4% decrease year-over-year, exceeding the estimated $90.01 billion.

Earnings Per Share (EPS): Achieved a record for the March quarter at $1.53, surpassing the estimated $1.50.

Net Income: Reached $23.64 billion, exceeding the quarterly estimate of $23.18 billion.

Services Revenue: Hit an all-time high at $23.87 billion, indicating strong growth in this sector.

Dividend Increase: Announced a 4% increase in quarterly dividend to $0.25 per share, reflecting confidence in financial stability.

Share Repurchase Authorization: Board authorized an additional $110 billion for stock buybacks, underscoring ongoing shareholder value enhancement.

Product Sales: Total product sales stood at $66.89 billion, with iPhone sales leading at $45.96 billion.

On May 2, 2024, Apple Inc (NASDAQ:AAPL) disclosed its financial outcomes for the fiscal second quarter ending March 30, 2024, through an 8-K filing. The tech giant reported a quarterly revenue of $90.8 billion, marking a 4% decrease from the previous year, yet managed to exceed the earnings per share (EPS) expectations with a record $1.53 against analysts' estimates of $1.50.

Company Overview

Apple Inc, a cornerstone of the technology sector, is renowned for its innovative product lines including the iPhone, iPad, Mac, and Apple Watch, centered around a robust software ecosystem. With significant contributions to both hardware and software markets, Apple continues to expand its technological footprint with services like Apple Music, iCloud, and the newly introduced Apple Vision Pro.

Performance Highlights and Strategic Developments

Despite the slight dip in total revenue, Apple achieved a new all-time high in its Services segment, which climbed to $23.867 billion from $20.907 billion in the previous year. This growth underscores Apple's successful diversification beyond hardware into more stable revenue streams. The quarter also saw the launch of Apple Vision Pro, highlighting Apple's push into spatial computing.

CEO Tim Cook expressed enthusiasm about the company's trajectory and upcoming initiatives, including a significant product announcement and the Worldwide Developers Conference. CFO Luca Maestri pointed to robust customer loyalty and satisfaction as key drivers of the quarter's success, which also led to a new record in EPS for a March quarter.

Financial Position and Shareholder Returns

Apple's commitment to returning value to shareholders remains steadfast, with the board authorizing an additional $110 billion for stock repurchases and a 4% increase in the quarterly dividend to $0.25 per share. These shareholder-friendly moves reflect confidence in the company's financial health and future prospects.

Detailed Financial Analysis

The condensed consolidated statements of operations reveal a mixed financial picture. While product sales saw a decline to $66.886 billion from $73.929 billion year-over-year, the increase in service revenue partially offset this drop. The total operating expenses were $14.371 billion, compared to $13.658 billion in the previous year, indicating increased investment in research and development as well as general administrative costs.

Apple's balance sheet remains robust with total assets of $337.411 billion and a significant liquidity position, evidenced by $32.695 billion in cash and cash equivalents. The firm's strategy of aggressive share repurchases and steady dividend payments also speaks to its strong cash flow management.

Market and Future Outlook

While Apple faces challenges like global economic uncertainties and competitive pressures, its strategic focus on expanding its services business and innovation in high-growth areas like spatial computing positions it well for future growth. The company's ability to maintain high levels of profitability and shareholder returns, despite revenue fluctuations, provides a reassuring sign of its operational and financial resilience.

In conclusion, Apple's Q2 earnings report paints a picture of a company navigating market challenges with strategic clarity and financial prudence. As Apple continues to innovate and expand its services, it remains a critical watch for investors interested in technology and consumer electronics sectors.

Explore the complete 8-K earnings release (here) from Apple Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finanza

Yahoo Finanza